In the fast-paced world of financial markets, technology is a driving force behind the way trades are executed. One of the most transformative innovations in trading today is ATS API (Automated Trading Systems Application Programming Interface) integration. By combining algorithmic trading with seamless data transfer, ATS API empowers traders to automate, execute, and manage trades more efficiently than ever before. However, like any trading strategy or technology, ATS API trading comes with its own set of advantages and challenges.

In this comprehensive guide, we will explore the pros and cons of ATS API trading, helping you decide whether it’s the right tool for your trading needs.

What is ATS API Trading?

Before diving into the benefits and drawbacks, let’s first clarify what ATS API trading means. An ATS (Automated Trading System) is a set of algorithms and strategies designed to automatically execute trades in financial markets based on predefined criteria. These algorithms are typically developed to take advantage of market opportunities at a high frequency, with minimal or no human intervention.

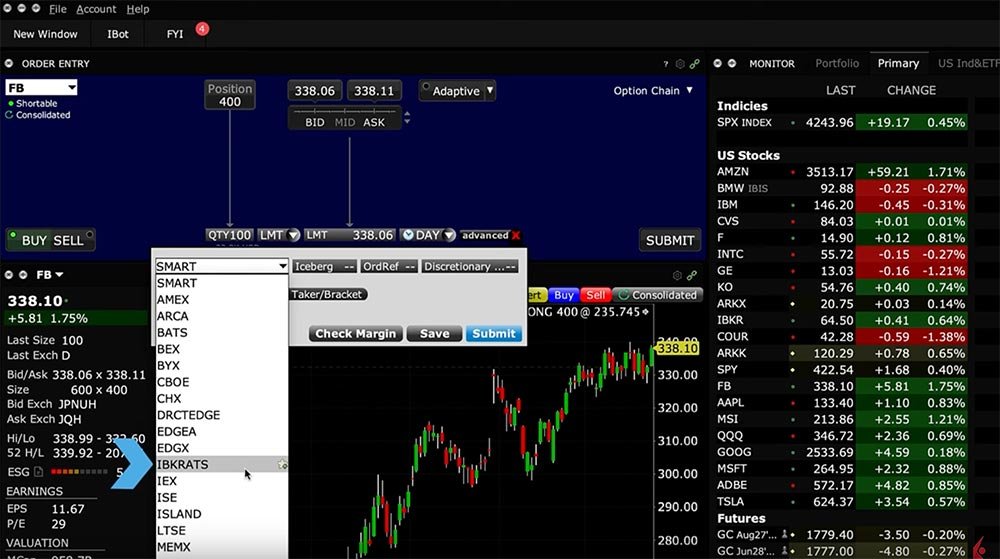

The ATS API is an interface that connects trading platforms, tools, or third-party systems to your ATS, enabling data exchange and seamless execution of trades. Through this API integration, traders can leverage different tools, such as data feeds, order management systems, and analytical platforms, while their ATS handles the actual execution.

In short, ATS API trading allows you to automate your trading strategies while ensuring smooth data flow between systems. It can be used in stock, forex, cryptocurrency, and other financial markets.

Pros of ATS API Trading

1. Speed and Efficiency

One of the most compelling reasons why traders adopt ATS API trading is speed. The financial markets are volatile, and timing is crucial to seizing opportunities. ATS API trading systems can execute trades in milliseconds, far faster than human traders ever could. Automated systems remove latency and improve order execution, allowing traders to capture even the smallest market inefficiencies.

For example, in high-frequency trading (HFT), algorithms can make hundreds or thousands of trades per second. With ATS API, this can be achieved without delay, making it highly advantageous in fast-moving markets like forex or cryptocurrency, where every second counts.

2. 24/7 Trading Capabilities

Unlike manual traders, automated trading systems don’t need rest. They can operate around the clock, providing you with the ability to trade in multiple global markets simultaneously. Whether you’re trading in the stock market, forex, or crypto markets, ATS API trading allows you to take advantage of opportunities no matter the time of day.

For instance, in the forex market, which operates 24/5, ATS API trading can monitor price fluctuations across multiple currency pairs, execute trades, and adjust positions in real time. This round-the-clock capability can be particularly valuable for traders who can’t afford to stay glued to their screens all day.

3. Reduced Emotional Bias

Human emotions like fear, greed, and impatience can cloud judgment and lead to poor trading decisions. One of the most significant advantages of ATS API trading is its ability to remove these psychological factors from the equation. The system executes trades based on predefined rules, irrespective of market sentiment or emotional states.

By eliminating emotional bias, ATS API trading can help traders stick to their strategies more consistently. Whether it’s staying in a trade longer than anticipated or cutting losses at the right moment, ATS API trading helps you maintain discipline, ensuring you follow your trading plan without emotional interference.

4. Improved Risk Management

Risk management is a critical component of any successful trading strategy. ATS API can be programmed to automatically set stop-loss orders, take-profit orders, and other risk management measures. For example, if a market moves against a position, the system can automatically trigger a stop-loss, limiting the trader’s exposure to risk.

Moreover, you can integrate risk management tools through the ATS API. These tools can monitor overall exposure, diversify across different asset classes, and adjust the trading strategy based on predefined risk parameters. The level of automation ensures that traders can mitigate risk without needing to constantly monitor the markets.

5. Scalability and Customization

As your trading needs evolve, ATS API trading provides scalability and customization. Unlike traditional manual trading, where managing multiple assets or markets requires a significant increase in human resources, ATS API enables automated systems to handle multiple trading pairs or instruments simultaneously.

You can also customize your ATS API trading strategies according to your risk tolerance, goals, and preferred trading style. Whether you are into day trading, swing trading, or long-term investing, you can adapt your automated system to execute trades according to your specific rules. Furthermore, as your strategy matures, you can scale it up to handle a larger volume of trades or explore additional markets.

Cons of ATS API Trading

1. Initial Setup and Technical Complexity

One of the most significant drawbacks of ATS API trading is the complexity of setting up and maintaining the system. Building an algorithmic trading strategy, ensuring it interacts seamlessly with various platforms, and integrating with APIs requires substantial technical knowledge. You will need to be familiar with programming languages such as Python, Java, or C++, or work with a developer to create custom solutions.

For those without a strong technical background, the learning curve can be steep. Even if you use a pre-built ATS API, you may still need to configure the system according to your trading preferences, which requires a degree of familiarity with APIs and algorithmic trading concepts.

2. Over-reliance on Algorithms

While ATS API trading can be incredibly efficient, it also creates a dependency on algorithms. The performance of the system is only as good as the algorithm that drives it. If the algorithm is poorly designed or the market experiences conditions it wasn’t programmed to handle, the results can be disastrous.

Moreover, ATS API trading is typically based on historical data, which may not always be a reliable predictor of future market conditions. A strategy that performed well in the past may struggle when market conditions change or become more volatile, leading to potential losses.

3. Risk of Technical Failures

Another potential disadvantage of ATS API trading is the risk of technical failures. If the system experiences glitches, connectivity issues, or errors in the code, it could result in missed trades, erroneous orders, or significant financial losses. These issues can be exacerbated in high-frequency trading environments, where every millisecond counts.

Moreover, market volatility can sometimes overwhelm an automated system, especially if it’s unable to react quickly enough to rapid price changes. Technical failures could be catastrophic if they occur during critical trading times, so it’s essential to implement safeguards and test your system rigorously.

4. Costs of Maintenance and Subscription

While ATS API trading can be cost-effective in terms of automation, there are ongoing costs that traders should consider. These costs may include subscription fees to access API services, hosting fees for running your trading algorithms, or fees for using data feeds. Additionally, if you’re working with a development team to build and maintain your system, there may be high upfront costs associated with creating a custom solution.

Moreover, keeping your trading system up to date requires constant monitoring and optimization. This can be time-consuming, especially as market conditions evolve, and there may be additional costs to modify the system to keep pace with new developments.

5. Security Risks

Since ATS API trading systems often involve the exchange of sensitive financial data, they can be vulnerable to security breaches or hacking attempts. If your system is compromised, malicious actors could manipulate trades, steal funds, or disrupt operations.

To minimize these risks, it’s essential to work with trusted API providers, use encryption, and maintain stringent cybersecurity protocols. However, like any digital trading tool, ATS API systems are not immune to cyber threats, and it’s critical to stay vigilant in securing your trading environment.

Is ATS API Trading Right for You?

The decision to adopt ATS API trading ultimately depends on your trading goals, technical expertise, and willingness to embrace automation. If you’re a seasoned trader with a solid understanding of algorithmic trading and a clear set of strategies, ATS API trading can be an invaluable tool that significantly enhances efficiency, speed, and profitability.

However, if you’re new to trading or lack the technical knowledge required to build and maintain an automated system, you may find the learning curve and complexity of ATS API challenging. In such cases, it might be more beneficial to start with simpler trading tools before venturing into algorithmic trading.

ATS API trading offers many advantages, but it also comes with risks and challenges that should not be overlooked. Carefully weigh the pros and cons, consider your resources, and decide whether the benefits align with your trading objectives.

Conclusion

ATS API trading has transformed the world of trading by offering speed, efficiency, and reduced emotional bias. It enables traders to manage risks effectively, trade around the clock, and scale strategies without the need for constant human intervention. However, it also comes with a steep learning curve, potential technical failures, and security risks that must be carefully managed.

If you have the expertise and resources to navigate these challenges, ATS API trading can be an excellent way to enhance your trading strategy. But for those just starting out, it’s essential to understand both the benefits and limitations before diving into automated trading systems. With the right approach and continuous monitoring, ATS API trading could be the edge you need to succeed in today’s competitive financial markets.