In a world of fluctuating markets and economic uncertainty, bullion coins have emerged as a trusted investment for individuals seeking to secure their wealth. Whether made from gold, silver, or other precious metals, these coins offer a tangible and reliable asset class with long-term value. This article explores the advantages of investing in bullion coins, how to acquire them using bullion by post services, and where to find bullion coins for sale through reputable dealers like Gold Investments.

What Are Bullion Coins?

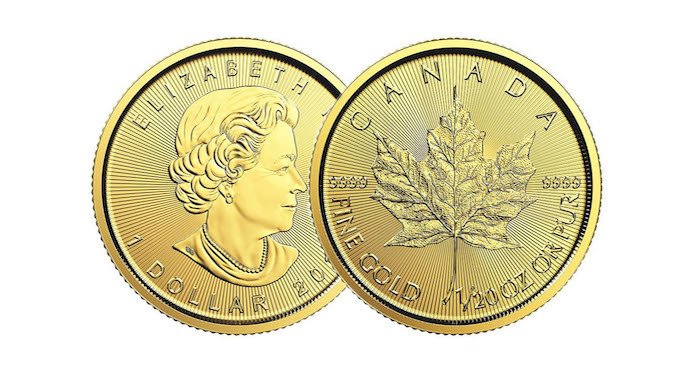

Bullion coins are minted from precious metals, primarily valued based on their metal content rather than their face value. Government mints produce these coins to specific standards of purity, making them suitable for both investment and collection. Common examples include:

- American Gold Eagle: Known for its liquidity and recognition worldwide, it’s a popular investment-grade coin.

- Canadian Maple Leaf: Made from 99.99% pure gold or silver, it’s celebrated for its purity and high demand.

- Krugerrand: South Africa’s famous gold coin, widely recognised for being the first modern bullion coin.

- Silver Britannia: The UK’s flagship silver coin, known for its .999 purity and classic design.

- Australian Kangaroo: A gold bullion coin that changes its design annually, making it attractive to collectors and investors.

With these coins, investors gain a physical asset with enduring value, making them a vital component of wealth preservation strategies.

Why Invest in Bullion Coins?

1. Tangible Asset Ownership

Bullion coins provide physical ownership of wealth. Unlike digital assets or stocks, which exist only on paper or online, these coins can be held, stored, and accessed directly, offering security in times of financial uncertainty.

2. Hedge Against Inflation

Precious metals have historically acted as a safeguard against inflation. When fiat currencies decline in value, the prices of metals like gold and silver typically rise, helping investors preserve their purchasing power.

3. Diversifying Investment Portfolios

Bullion coins offer crucial diversification. They behave differently from other asset classes, such as stocks and bonds, and often retain or increase their value during economic downturns, stabilising your portfolio.

4. High Liquidity

Bullion coins are easy to buy, sell, or trade, thanks to their global recognition. Whether you need to liquidate your investment quickly or trade for other assets, these coins provide high liquidity.

5. Potential for Long-Term Appreciation

In addition to their intrinsic value, certain bullion coins can appreciate over time due to limited mintage, rarity, or collector demand. Investors looking for long-term gains may benefit from exploring these niche opportunities.

How to Acquire Bullion Coins

1. Bullion by Post Services

A popular and convenient way to purchase bullion coins is through bullion by post services. This method allows you to buy coins online and have them delivered directly to your home, ensuring a secure and straightforward transaction.

When choosing a bullion by post service, it’s essential to work with a reputable dealer. Look for companies that offer insured shipping, transparent pricing, and secure payment methods. Customer reviews and testimonials are also useful indicators of a dealer’s trustworthiness.

2. Bullion Coins for Sale from Dealers

You can also find bullion coins for sale through established dealers or local coin shops. This option lets you inspect the coins in person before making a purchase, ensuring their authenticity and quality.

Trusted dealers like Gold Investments offer a wide range of bullion coins for sale, from popular choices to rare editions. Their expertise and market insights can help you make informed investment decisions tailored to your financial goals.

Key Considerations When Investing in Bullion Coins

1. Market Volatility

Precious metal prices can fluctuate due to economic and geopolitical factors. Staying informed about market trends can help you time your purchases effectively and maximise your returns.

2. Storage and Security

Since bullion coins are physical assets, secure storage is essential. Consider using a home safe, a bank deposit box, or a professional vault service. Some companies also offer insured storage solutions for additional peace of mind.

3. Understanding Total Costs

Be aware of all costs involved in purchasing bullion coins, including dealer premiums, shipping fees, and taxes. Understanding these expenses ensures you get the best value from your investment.

4. Long-Term Strategy

Bullion coins are often best suited for long-term investment. Although they can be traded short-term, holding onto these assets over time allows for potential appreciation and enhanced wealth protection. Establishing a clear strategy helps you stay focused on your financial objectives, even during market fluctuations.

Conclusion

Bullion coins offer a secure, tangible way to protect and grow your wealth. Whether you’re looking for a hedge against inflation, a means of diversifying your portfolio, or a long-term investment, bullion coins provide stability and flexibility. With high liquidity and the potential for appreciation, they remain a trusted asset in uncertain economic times.

Whether you prefer the convenience of bullion by post services or prefer to explore bullion coins for sale through trusted dealers like Gold Investments, understanding the market and working with reputable sources will empower you to make informed decisions. By incorporating bullion coins into your financial strategy, you can build long-term wealth and secure your financial future with confidence.